Multi-asset portfolio management is a dynamic and sophisticated investment strategy that aims to balance risk and return by diversifying investments across various asset classes. This comprehensive approach to portfolio management has become increasingly popular among investors seeking to navigate complex market environments and achieve specific investment objectives. In this detailed article, we will explore the intricacies of multi-asset portfolio management, its benefits, strategies, challenges, and future trends, catering specifically to portfolio management professionals.

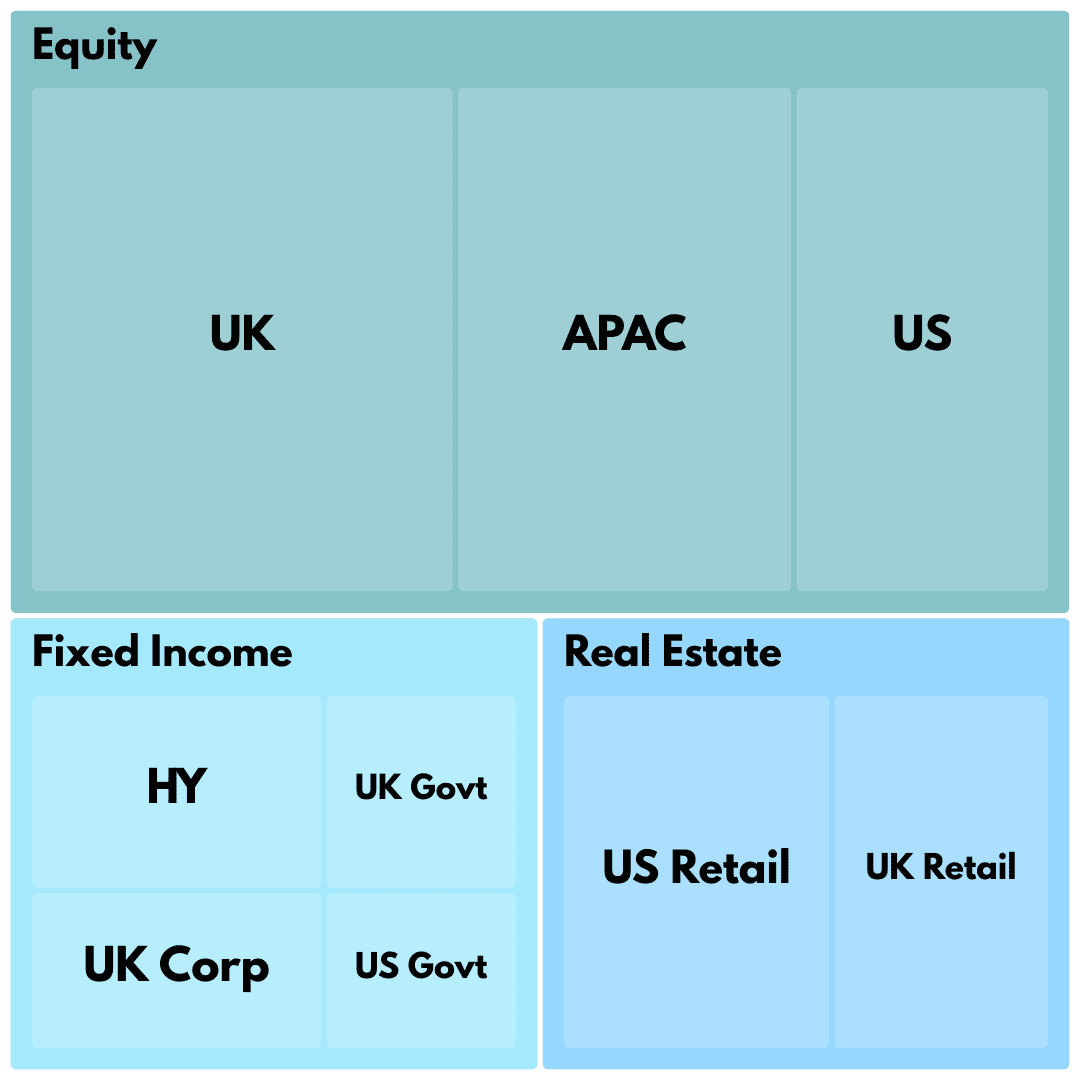

Multi-asset portfolio management involves investing in a mix of asset classes, such as stocks, bonds, real estate, commodities, and alternative investments, in a single portfolio. This approach contrasts with single-asset-class investing, where the focus is on one particular type of investment. The key objective of multi-asset portfolio management is to achieve a diversified investment mix that can potentially reduce volatility and improve returns over the long term.

Multi-asset portfolio management is about finding the right balance between risk and reward by diversifying investments across various asset classes. This strategy is designed to help investors achieve more stable and potentially higher returns over the long term, making it a popular choice for individuals and institutions alike seeking to optimize their investment outcomes.

The underlying rationale for multi-asset portfolio management is based on the principle of diversification. Different asset classes often respond differently to economic events and market conditions. By combining these assets, multi-asset portfolios aim to smooth out the performance, reducing the impact of market volatility on the overall portfolio. This diversification can potentially lead to more consistent returns and a better risk-adjusted performance over time.

This is the process of deciding how to distribute investments among different asset classes. It is the most critical decision in multi-asset portfolio management, as it significantly impacts the risk and return profile of the portfolio.

Beyond just investing in multiple asset classes, diversification in a multi-asset portfolio also involves spreading investments within each asset class. This can include investing in different sectors, geographic regions, and investment styles.

Effective risk management is crucial in multi-asset portfolio management. This involves not only understanding the risks associated with each asset class but also how these risks interact within the portfolio.

Portfolios need regular rebalancing to maintain the desired asset allocation, as market movements can shift the weightings of different assets over time.

This approach involves setting target allocations for various asset classes based on the investor’s risk tolerance, time horizon, and investment objectives. The portfolio is periodically rebalanced back to these target allocations.

Tactical asset allocation allows for short-term deviations from the strategic asset allocation to capitalize on market opportunities or avoid potential risks. This approach requires active management and a deep understanding of market trends.

Dynamic asset allocation involves continuously adjusting the mix of asset classes in response to changing market conditions. It is a more proactive approach than strategic or tactical asset allocation and requires sophisticated market analysis.

Advanced data analytics and predictive modelling are increasingly being used to gain insights into market trends and to help in making more informed investment decisions.

These technologies are used for understanding complex strategies, managing risk, and optimizing portfolio allocations efficiently and at scale.

Multi-asset portfolio management is a nuanced and dynamic approach to investing that offers the potential for risk-adjusted returns and portfolio diversification. As the financial markets continue to evolve, the importance of a well-structured multi-asset portfolio strategy cannot be overstated for portfolio management professionals. Understanding the complexities and staying abreast of new trends and technologies will be crucial in effectively managing multi-asset portfolios in the years ahead.