The journey of a bond begins with its issuance, which is how entities raise money for various purposes. Here’s a step-by-step breakdown of the bond issuance process:

A government or corporation decides to raise funds through a bond issue, typically for long-term investment projects or to refinance existing debt.

The issuer determines the bond’s key features, including the face value (the amount borrowed that will be repaid at maturity), the coupon rate (the interest rate paid to bondholders), and the maturity date (when the bond will come due).

Often, especially in the case of corporate bonds, an underwriter (usually a bank) is involved to help price and sell the bond. The underwriter buys the bonds from the issuer and sells them to investors.

The bonds are then offered to investors, either through a public offering or private placement.

Throughout the life of the bond, the issuer makes regular interest payments to bondholders, typically semi-annually.

Upon reaching its maturity date, the bond’s face value is repaid to the bondholders, marking the end of the bond’s life.

One of the key aspects of understanding bonds is the inverse relationship between bond prices and interest rates:

This relationship is crucial for investors to understand, as it affects the market value of bonds they may want to buy or sell before maturity.

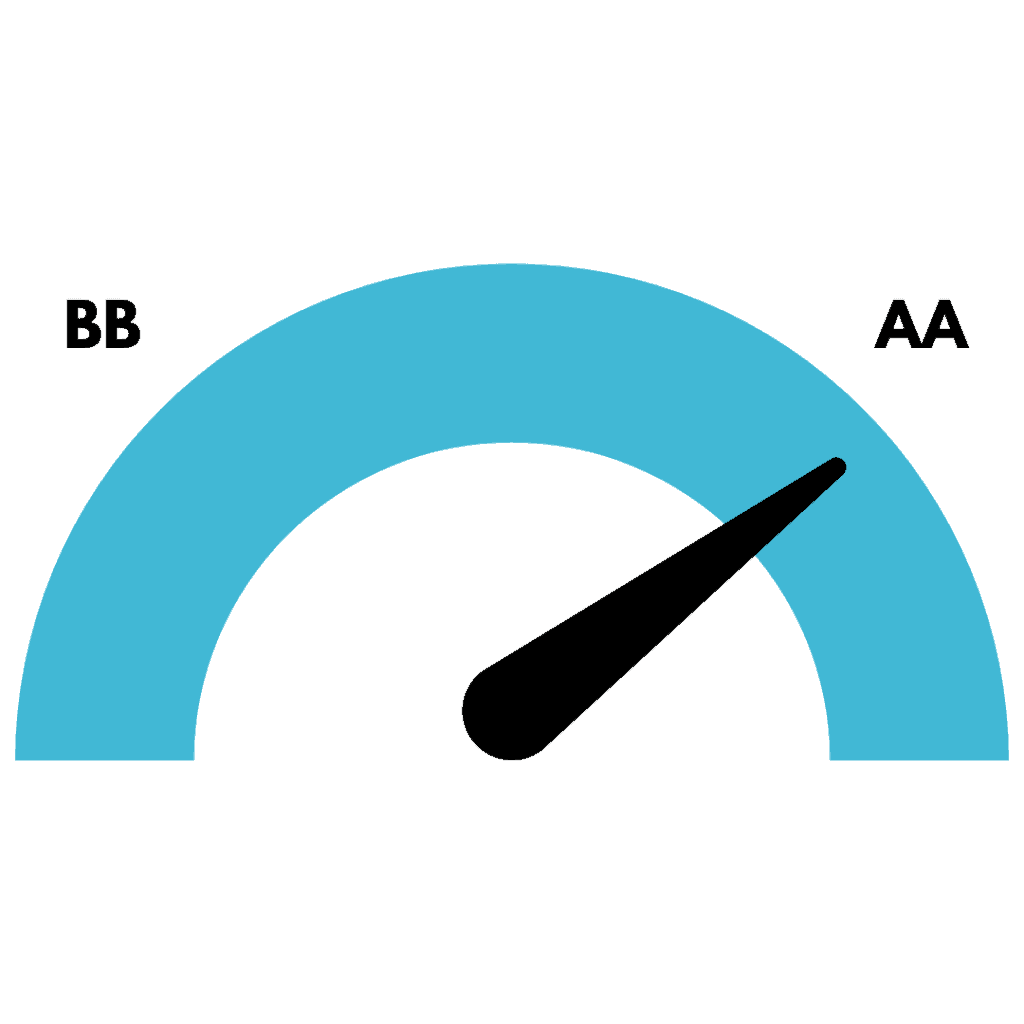

Credit ratings are vital in the bond market as they provide an assessment of the issuer’s ability to make interest payments and repay the bond at maturity:

Indicate a strong ability to meet financial commitments and a lower risk of default. Such bonds usually offer lower interest rates.

Suggest a higher risk of default. These bonds, often referred to as high-yield or junk bonds, need to offer higher interest rates to attract investors.

Credit rating agencies like Moody’s, Standard & Poor’s, and Fitch Ratings evaluate and assign these ratings based on the issuer’s financial health and other factors.

Understanding how bonds work is essential for investors and financial professionals. The process of bond issuance, the relationship between bond prices and market interest rates, and the importance of credit ratings form the backbone of bond investing. Grasping these concepts enables investors to make informed decisions and better assess the risks and rewards associated with different types of bonds.