Regulatory compliance is the silent backbone of every investment decision. Whether you manage a single‑strategy hedge fund or a multi‑asset pension mandate, every order must clear a thicket of global rules before, during, and long after it hits the market.

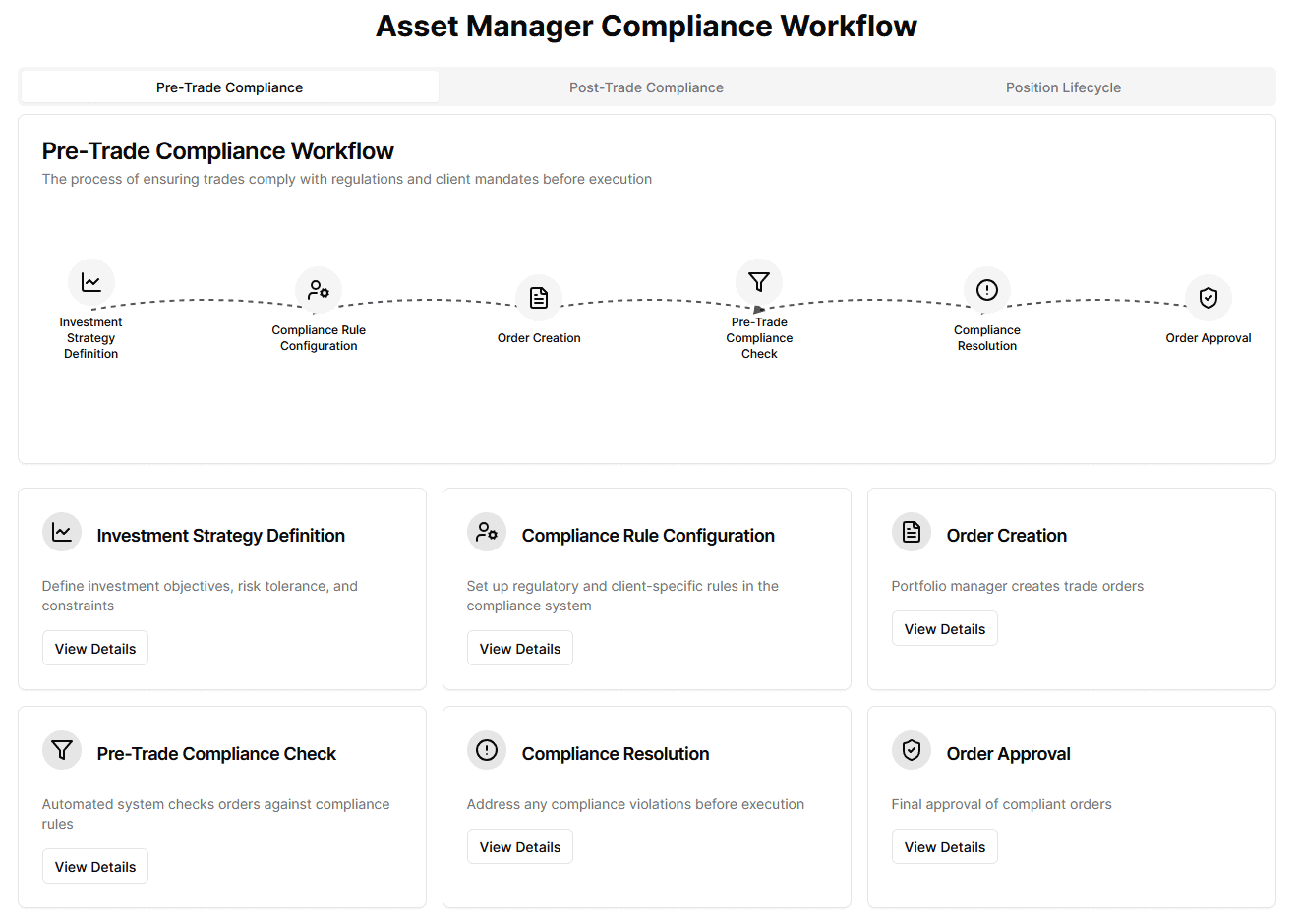

To demystify this process, Acclimetry’s Asset Manager Compliance Workflow provides an interactive, end‑to‑end visualisation of the pre‑trade checks that stop forbidden orders at source, the post‑trade controls that confirm the portfolio is still clean, and the ongoing position‑lifecycle monitoring that catches breaches that materialise months later.

This article explains the concepts behind each stage and shows you exactly how to explore them in the tool.

Link to the tool: https://complianceworkflowguide.acclimetry.com/

The workflows you are about to explore model the operational safeguards asset managers deploy to stay on the right side of all three pressures.

Tip: Resolve all soft and hard breaches in the interactive flow to unlock the Approve & Execute button.

Even a perfectly compliant trade can become non‑compliant as markets move, companies merge, or the portfolio is rebalanced.

Mode | Best For | Where to Find |

Diagram | Quick orientation, teaching cohorts | Default tabs on / |

Step Cards | Self‑paced reading, reference | Scroll below each diagram |

Interactive Workflow | Training, workshops, demos | /interactive |

Compliance is not a single checkpoint but a continuous feedback loop spanning idea generation to the last penny of residual value. By visualising that loop, Acclimetry turns abstract obligations into tangible, teachable flows. We hope the tool equips you to spot gaps, refine processes, and above all, trade with confidence.

Questions or feedback? Send us a message from: https://acclimetry.com/contact/