A well-diversified investment portfolio is key to managing risk and achieving steady returns over time. Bonds play a crucial role in this diversification, offering unique benefits that can balance and complement other investment types, such as stocks.

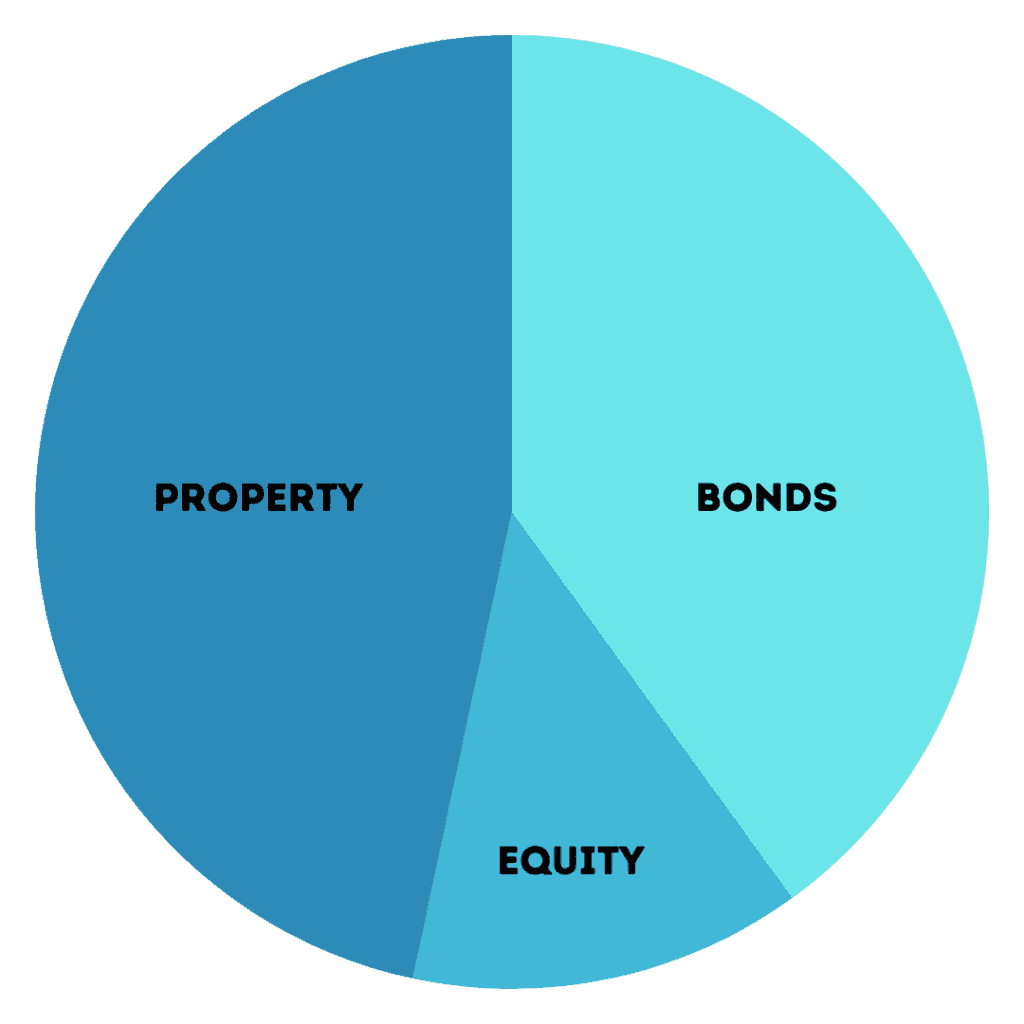

Asset allocation is about dividing your investment portfolio among different asset categories, like stocks, bonds, and cash. Here’s how bonds contribute to this mix:

Bonds typically have lower volatility compared to stocks, making them a stabilizing force in a portfolio, especially during market downturns.

Bonds provide regular income through interest payments, which can be particularly valuable in a low-interest-rate environment.

Understanding the differences between bonds and stocks is vital for effective portfolio diversification:

Stocks generally offer higher potential returns but come with higher volatility and risk. Bonds, on the other hand, usually provide lower, but more stable, returns.

Bonds and stocks often react differently to market events. For example, bond prices might rise when stock prices fall, as investors seek safer assets.

Diversification within a bond portfolio is also important:

Including a mix of government, corporate, and municipal bonds can help manage risks associated with specific sectors.

A mix of short, medium, and long-term bonds, as well as a spread across different credit ratings, can further balance risk.

The role of bonds can vary across different market cycles:

During downturns or periods of uncertainty, bonds, especially government bonds, can provide a safe haven.

In times of economic growth, corporate bonds might offer better returns due to the improving financial health of businesses.

Inflation can impact the real returns of bonds:

Instruments like Treasury Inflation-Protected Securities (TIPS) in the U.S. can help protect against inflation risk.

Incorporating bonds into an investment portfolio is a strategic decision that can enhance stability, provide income, and help manage risk. By understanding how bonds compare with other assets like stocks, and by diversifying within the bond category itself, investors can craft a portfolio that aligns with their risk tolerance, investment goals, and market conditions. Bonds are not just about safety; they are about strategic balance in the pursuit of long-term financial success.