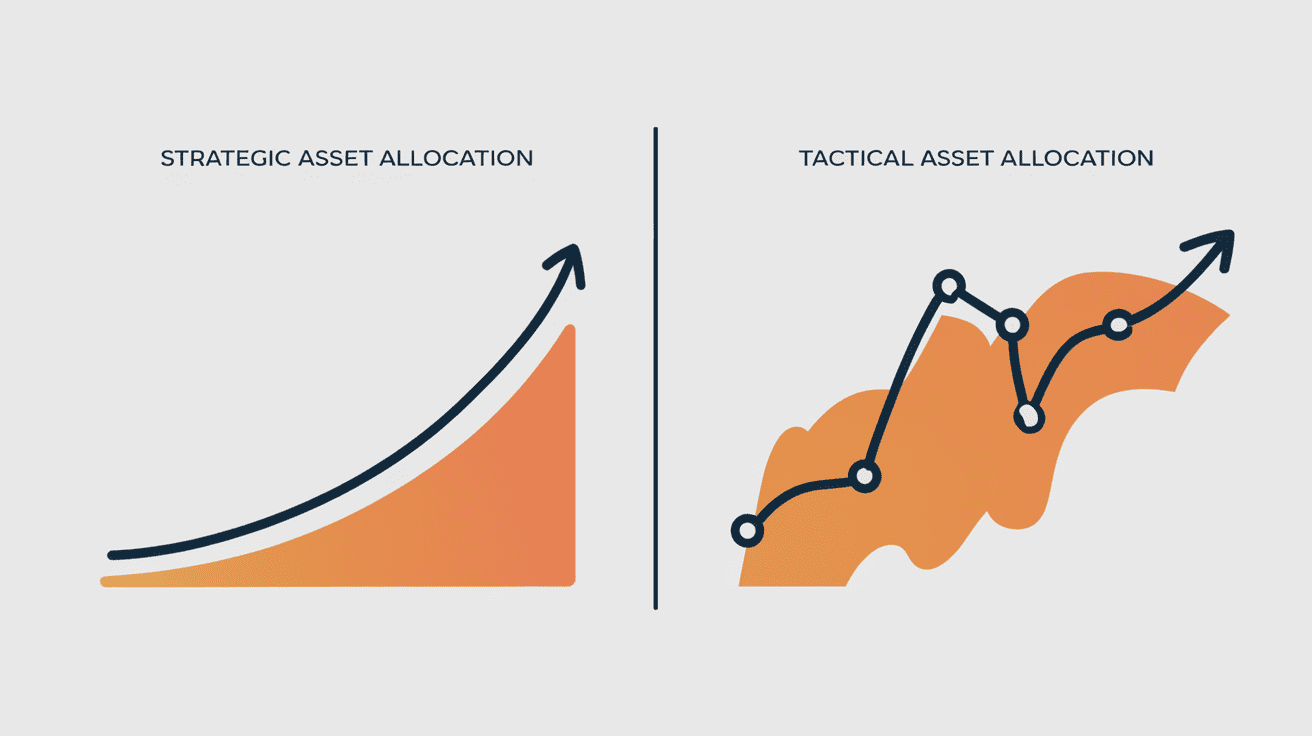

The cornerstone of any robust investment strategy lies in the effective allocation of assets. This fundamental process involves distributing investment capital across various asset classes, such as equities, bonds, and real estate, with the primary objective of balancing potential returns against an acceptable level of risk. By strategically diversifying holdings, investors aim to enhance long-term portfolio performance and mitigate the impact of market volatility. Within the realm of asset allocation, two dominant approaches guide investment decisions: strategic asset allocation (SAA) and tactical asset allocation (TAA). Understanding the nuances of each strategy, their core principles, and how they differ is crucial for investors seeking to navigate the complexities of the financial markets and achieve their financial objectives. This article provides a comprehensive analysis of SAA and TAA, exploring their characteristics, comparing their methodologies, and examining how they can be effectively employed to construct and manage investment portfolios.

Strategic asset allocation (SAA) represents a long-term investment philosophy centered on establishing and maintaining a specific mix of asset classes within a portfolio. This allocation is meticulously crafted based on a thorough understanding of long-term capital market forecasts, the investor’s unique financial goals, their capacity and willingness to tolerate risk, and their investment time horizon. The core principles underpinning SAA provide a framework for building resilient portfolios designed to achieve sustained growth over an extended period.

A fundamental tenet of SAA is its long-term focus, typically spanning five to ten years or even longer. This extended investment horizon allows the portfolio to potentially weather short-term market fluctuations and capitalize on the inherent long-term growth potential of various asset classes. The allocation strategy is also deeply rooted in the investor’s risk tolerance, which dictates the proportion of growth assets (like equities) versus defensive assets (like bonds and cash) within the portfolio. Investors with a higher risk tolerance might opt for a larger allocation to equities to pursue potentially higher returns, while those with a lower tolerance might favor a more conservative mix with a greater emphasis on fixed income.

Diversification is another cornerstone of SAA, emphasizing the importance of spreading investments across a variety of asset classes. By investing in assets with low or negative correlations, investors can mitigate the risk associated with any single asset class underperforming. SAA also promotes disciplined investing, encouraging investors to adhere to their long-term plan and avoid making impulsive decisions driven by short-term market noise or emotional reactions. Finally, periodic rebalancing is integral to SAA, involving the adjustment of the portfolio back to its original target allocations at predetermined intervals, such as annually or quarterly. This process ensures that the portfolio’s risk and return characteristics remain aligned with the investor’s long-term objectives.

Several factors influence the construction of an SAA portfolio, including the investor’s age, specific financial goals (e.g., retirement, education funding), and liquidity needs. For instance, a younger investor with a long time horizon might allocate more heavily to growth-oriented assets, while an investor nearing retirement might prioritize capital preservation with a larger allocation to more stable assets. This personalized approach underscores that SAA is not a one-size-fits-all strategy but rather a tailored framework designed to meet individual circumstances. This long-term, stable framework acts as a reliable guide for investment strategies, helping investors maintain their course through the inevitable ups and downs of the market. This stability can be particularly valuable for investors who might be susceptible to making emotional investment decisions during periods of market volatility. While some simplified rules of thumb, such as the “Rule of 100/110/120,” suggest a straightforward method for determining stock allocation based on age, their limitations in today’s environment of increasing lifespans and evolving market dynamics highlight the need for more sophisticated and personalized approaches to SAA.

In contrast to the long-term, strategic nature of SAA, tactical asset allocation (TAA) is an active management strategy focused on making short-term adjustments to asset allocations to capitalize on perceived market opportunities and inefficiencies. TAA involves actively shifting the percentage of assets held in various categories based on market trends, economic conditions, and valuation shifts, with the aim of enhancing returns or mitigating risks over a shorter timeframe.

TAA is characterized by its short-term focus, typically spanning from three months to one year. This necessitates active management, requiring continuous monitoring of market trends, economic indicators, and investor sentiment to identify potential opportunities for tactical adjustments. The strategy offers flexibility, allowing portfolio managers to deviate from the long-term strategic asset allocation to overweight or underweight specific asset classes, sectors, or regions based on their short-term outlook. The primary goal of TAA is to achieve potentially higher returns by strategically positioning the portfolio to benefit from anticipated market movements and exploiting perceived mispricings. This often involves more frequent adjustments to the portfolio compared to SAA, with rebalancing occurring as market opportunities arise or dissipate.

TAA can be broadly categorized into two main types: discretionary and systematic. Discretionary TAA relies on the investment manager’s judgment and market insights to make allocation decisions, often based on fundamental or technical analysis. Systematic TAA, on the other hand, employs quantitative models and predefined rules to identify and exploit market inefficiencies. While TAA presents the potential for enhanced returns by capitalizing on short-term market fluctuations, it also carries inherent risks. The success of TAA hinges on the ability to accurately predict market movements, a practice often referred to as “market timing,” which is notoriously difficult and has a historically low success rate. Furthermore, frequent trading associated with TAA can lead to higher transaction costs and potential tax implications. If not implemented with a disciplined and systematic approach, TAA can also be more susceptible to emotional decision-making. The reliance on short-term forecasting, which has a narrow margin for error, underscores the challenging nature of consistently generating alpha through tactical adjustments.

Strategic asset allocation and tactical asset allocation represent distinct approaches to portfolio management, each with its own set of characteristics and underlying philosophy. The primary differences lie in their time horizon, the frequency with which adjustments are made to the portfolio, and the fundamental beliefs that drive each strategy.

Characteristic | Strategic Asset Allocation (SAA) | Tactical Asset Allocation (TAA) |

Time Horizon | Long-term (5-10 years or more) | Short-term (3 months to 1 year) |

Frequency of Adjustments | Periodic, less frequent (e.g., annually, quarterly rebalancing) | More frequent, active adjustments based on market opportunities |

Underlying Philosophy | Stability, diversification, buy-and-hold, long-term fundamentals, investor profile | Flexibility, capitalizing on short-term market inefficiencies and trends |

SAA adopts a long-term perspective, focusing on building a portfolio that aligns with an investor’s objectives and risk tolerance over an extended period. In contrast, TAA operates on a shorter-term time horizon, aiming to take advantage of market conditions and potential gains within a year.

The frequency of adjustments also distinguishes the two strategies. SAA typically involves periodic rebalancing, often annually or quarterly, to bring the portfolio back to its target asset allocation. TAA, however, requires more frequent and active adjustments to the portfolio’s asset allocation in response to changing market dynamics and perceived opportunities. This difference in adjustment frequency has implications for transaction costs, tax considerations, and the level of ongoing portfolio management required.

The underlying philosophies of SAA and TAA are fundamentally different. SAA emphasizes stability and diversification, adhering to a buy-and-hold approach based on long-term economic and market fundamentals and the investor’s individual profile. It operates on the principle that asset allocation is the primary driver of long-term returns. TAA, conversely, adopts a more active and flexible approach, seeking to capitalize on short-term market inefficiencies and trends by making tactical shifts in asset allocation. SAA is often viewed as a more passive investment style, while TAA aligns with active management strategies, reflecting varying degrees of investor engagement and conviction in the ability to outperform the market. Ultimately, the choice between SAA and TAA often hinges on the investor’s risk tolerance, the time they are willing to dedicate to managing their portfolio, their level of investment expertise, and their beliefs about the efficiency of the financial markets.

Strategic and tactical asset allocation are not mutually exclusive strategies; in fact, they can be effectively integrated within a portfolio to potentially leverage the benefits of both long-term stability and short-term opportunities. Two common methods for achieving this balance are the core-satellite approach and dynamic allocation strategies.

The core-satellite approach involves constructing a portfolio with two main components. The “core” of the portfolio, typically comprising a significant portion (e.g., 70-80%), follows a long-term SAA strategy. This core provides stability and broad diversification through passive investments such as index funds or exchange-traded funds (ETFs) that track major market benchmarks. The “satellite” portion, representing a smaller allocation (e.g., 20-30%), employs a TAA strategy to pursue short-term gains through active management in specific sectors, regions, or asset classes that are perceived to offer attractive opportunities. The allocation ratio between the core and satellite can be adjusted based on the investor’s risk appetite, with more conservative investors potentially favoring a larger core allocation. This approach allows investors to benefit from the stability and lower costs associated with passive investing in the core, while still having the flexibility to potentially enhance returns through tactical adjustments in the satellite portion.

Dynamic allocation strategies represent a more active approach to integrating long-term strategic considerations with short-term tactical adjustments. Dynamic asset allocation (DAA) involves frequently adjusting the mix of asset classes within a portfolio based on evolving market trends and economic conditions. Unlike SAA, DAA often does not adhere to a fixed target asset mix, allowing for greater flexibility in response to perceived risks and opportunities. DAA can be viewed as a more active and adaptive form of TAA, or as a distinct strategy that can complement a long-term strategic framework. Examples of dynamic strategies include increasing equity exposure during periods of economic growth, shifting towards more defensive assets like bonds or cash during market downturns, or adjusting allocations based on macroeconomic forecasts. While DAA offers the potential for higher returns by capitalizing on market momentum and mitigating losses during downturns, it typically involves higher transaction costs and relies heavily on the portfolio manager’s ability to make timely and accurate investment decisions.

Portfolio rebalancing is a critical process in asset allocation, involving the periodic adjustment of a portfolio’s asset mix to return it to its predetermined target allocation. Over time, the performance of different asset classes will inevitably vary, causing the portfolio’s actual allocation to drift away from the intended strategic or tactical targets. Rebalancing is essential for maintaining the desired risk and return characteristics of the portfolio.

In the context of SAA, rebalancing plays a crucial role in ensuring that the portfolio remains aligned with the long-term strategic targets established based on the investor’s risk tolerance, time horizon, and financial goals. Without regular rebalancing, a portfolio could become overweight in outperforming assets, potentially increasing the overall risk beyond the investor’s comfort level. For TAA, rebalancing might involve adjusting the portfolio back to its underlying strategic allocation after taking advantage of short-term tactical opportunities. It can also entail making adjustments to the tactical allocations themselves as market conditions change and new opportunities arise.

Rebalancing offers several key benefits, including effective risk management by preventing overexposure to riskier assets, maintaining the intended investment strategy by ensuring the portfolio aligns with long-term objectives, and the potential to lock in gains and buy low by selling overperforming assets and reinvesting in underperforming ones. It also promotes disciplined investing by reducing the influence of emotional decision-making and helps in optimizing returns for a given level of risk. Common rebalancing strategies include calendar-based rebalancing, where adjustments are made at predetermined intervals (e.g., annually, quarterly), threshold-based rebalancing, which triggers adjustments when asset allocations deviate from their targets by a specific percentage, and hybrid approaches that combine elements of both. When rebalancing, it is important to consider transaction costs associated with buying and selling assets, as well as potential tax implications, especially in taxable accounts. Rebalancing inherently acts as a contrarian strategy, encouraging investors to sell assets that have performed well and buy those that have lagged, which can contribute to improved long-term returns and reduced overall portfolio risk.

Strategic asset allocation offers several compelling benefits for long-term investors. One of its primary advantages is diversification, which involves spreading investments across various asset classes. By allocating capital to a mix of assets that tend to perform differently under various market conditions, SAA helps to mitigate the risk of significant losses from any single investment or asset class. This diversification contributes to more stable and predictable long-term returns.

SAA also promotes disciplined investing, encouraging investors to adhere to a well-defined plan and avoid making emotional or reactive decisions based on short-term market fluctuations. By focusing on long-term objectives and adhering to the strategic asset mix, investors are less likely to be swayed by market noise or short-lived trends, which can often lead to suboptimal investment choices. This disciplined approach is crucial for weathering market cycles and ultimately achieving long-term financial goals.

Beyond diversification and discipline, SAA offers other notable benefits. It is generally easier to maintain compared to more active strategies like TAA, requiring less frequent adjustments and monitoring. SAA is also inherently aligned with individual investor profiles, taking into account their specific financial goals, risk tolerance, and time horizon to create a tailored investment strategy. Furthermore, the long-term holding periods associated with SAA can potentially lead to tax benefits, such as lower capital gains tax rates on assets held for more than a year. In essence, SAA provides a clear and understandable investment roadmap, empowering investors to stay focused on their long-term financial aspirations and manage their expectations during periods of market volatility.

Tactical asset allocation offers distinct advantages for investors seeking to potentially enhance their portfolio returns by actively responding to short-term market dynamics. One of the key benefits of TAA is its ability to capture short-term market gains. By strategically adjusting asset allocations to take advantage of perceived short-term mispricings or emerging trends, investors can potentially outperform a purely strategic, long-term approach. This active management allows for capitalizing on specific market opportunities as they arise.

TAA also provides the flexibility to adapt to dynamic market changes. In response to evolving economic conditions, shifts in market sentiment, or geopolitical events, portfolio managers employing TAA can make timely adjustments to the asset mix. This adaptability can be crucial for mitigating potential risks during market downturns by shifting towards more defensive assets. Furthermore, TAA can lead to increased portfolio diversification by strategically allocating to different sectors, regions, or even within asset classes based on short-term outlooks. This active approach also presents the opportunity to exploit market inefficiencies – temporary imbalances between an asset’s intrinsic value and its market price – to potentially generate higher returns. TAA can be a valuable tool for investors who possess the knowledge, skills, and time to actively monitor the market, or for those who work with experienced financial advisors capable of identifying and acting on short-term opportunities.

Strategic asset allocation and tactical asset allocation are implemented in various ways in real-world investment scenarios, reflecting the diverse needs and objectives of investors.

In strategic asset allocation, a common example involves a young investor with a long investment horizon, such as retirement decades away. This investor might adopt an aggressive SAA with a significant allocation to equities (e.g., 70-90%), a smaller allocation to bonds (e.g., 10-20%), and a minimal allocation to cash 4. The rationale is that over a long period, equities have historically provided higher returns, and the investor has ample time to recover from any short-term market downturns. Conversely, an investor nearing retirement might shift towards a more conservative SAA, with a larger allocation to fixed income (e.g., 40-60%) to prioritize capital preservation and income generation, and a reduced allocation to equities (e.g., 30-50%) to manage risk. Regardless of the specific allocation, investors following an SAA strategy typically rebalance their portfolios periodically, such as annually or quarterly, to bring the asset class weights back to their target levels. For instance, if a portfolio’s target is 60% stocks and 40% bonds, and after a year stocks have outperformed and now represent 70% of the portfolio, the investor would sell some stocks and buy more bonds to restore the 60/40 balance. These examples illustrate how SAA directly links an investor’s characteristics and long-term goals to the structure of their portfolio.

Tactical asset allocation is often implemented in response to specific market events or economic forecasts. For example, if there are growing concerns about an impending recession, a portfolio manager employing a TAA strategy might temporarily reduce the allocation to equities and increase the allocation to bonds or cash, which are generally considered safer assets during economic downturns. Conversely, if a particular sector, such as technology, is expected to experience significant growth due to new innovations or market trends, a TAA manager might tactically increase the portfolio’s exposure to that sector, potentially by overweighting technology stocks or investing in sector-specific ETFs. TAA can also involve making adjustments within an asset class. For instance, if interest rates are expected to rise, a manager might tactically favor short-term bonds over long-term bonds within the fixed income portion of the portfolio, as short-term bonds are typically less sensitive to interest rate changes. These examples demonstrate the proactive nature of TAA in seeking to capitalize on specific short-term market opportunities and manage potential risks.

Strategic asset allocation and tactical asset allocation offer distinct yet valuable frameworks for managing investment portfolios. SAA provides a long-term, disciplined approach centered on diversification and alignment with an investor’s unique profile. Its emphasis on stability and periodic rebalancing makes it a suitable strategy for investors seeking consistent, long-term growth while mitigating risk. TAA, on the other hand, offers a more active and flexible approach, allowing investors to potentially enhance returns by capitalizing on short-term market opportunities and adapting to evolving economic conditions.

The decision of whether to adopt SAA, TAA, or a combination of both ultimately depends on an individual investor’s specific circumstances, financial goals, risk tolerance, time horizon, and investment expertise. Many investors may find that a balanced approach, such as the core-satellite strategy, offers an optimal solution by combining the stability and cost-effectiveness of a long-term strategic core with the potential for tactical gains in a smaller satellite portion. Regardless of the chosen asset allocation strategy, regular portfolio review and rebalancing remain essential practices for maintaining the desired risk and return characteristics and ensuring that the portfolio stays aligned with the investor’s evolving needs and objectives.